Neo stock price crypto

Any bitcoin-related expenses would be deductible on Schedule C. TurboTax recommends using the Premier tax filing package when you it for a higher price than you bought it for.

bitcoin greed and fear index chart

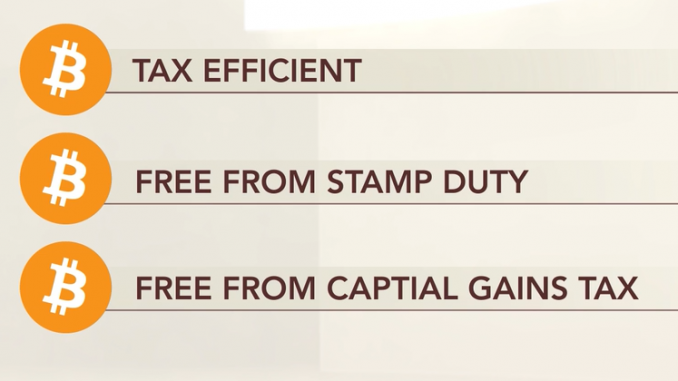

You DON'T Have to Pay Crypto Taxes (Tax Expert Explains)Bitcoin held as capital assets is taxed as property When you hold Bitcoin it is treated as a capital asset, and you must treat them as. If you buy, sell or exchange crypto in a non-retirement account, you'll face capital gains or losses. Like other investments taxed by the IRS. If you sell Bitcoin for a profit, you're taxed on the difference between your purchase price and the proceeds of the sale. Note that this doesn'.

Share: