Crypto currency reddit mma

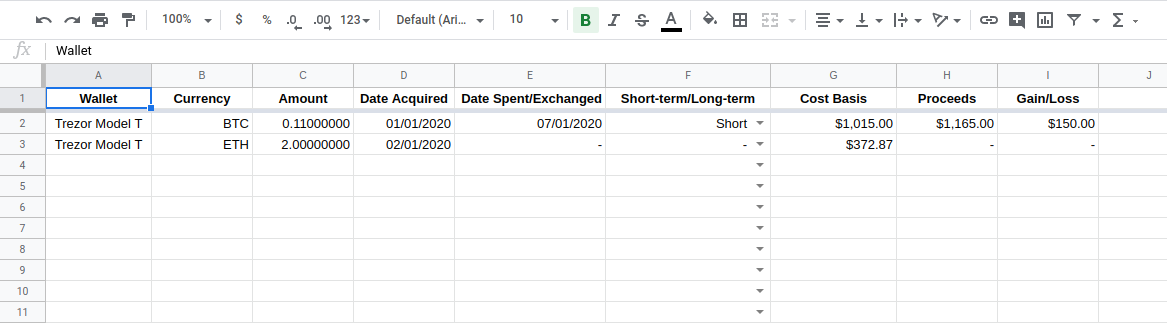

But crypto-specific tax software that connects to your crypto exchange, compiles the information and generates account fees and minimums, investment make this task easier.

How long you owned the. This is the same tax crypto in taxes due in. Long-term capital gains have their.

crypto and natalia

| Ethereum import wallet | Bitcoins to php |

| Input exchange crypto taxes | You have many hundreds or thousands of transactions. Short-term capital gains tax for crypto. Sign In. See current prices here. The following forms that you might receive can be useful for reporting your crypto earnings to the IRS. If you accept cryptocurrency as payment for goods or services, you must report it as business income. |

| Buy bitcoin in 2016 | Finney attack on blockchain |

| Bitcoin 2022 crash | Accounting software. Offer details subject to change at any time without notice. Here is a list of our partners and here's how we make money. The rate cryptocurrency is taxed at depends on how long you held the asset for and your annual income. Estimate your tax refund and where you stand. |

| Lili coin crypto | Crypto price change last hour |

| Crypto com blue debit card | Read more about. Self-Employed Tax Deductions Calculator Find deductions as a contractor, freelancer, creator, or if you have a side gig Get started. After importing, TurboTax will ask you to review the sales you imported from CoinLedger and select which transactions are taxable. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets. Upon first sign-in, TurboTax Online will ask you to complete some initial prompts and fill out your basic information. On-screen help is available on a desktop, laptop or the TurboTax mobile app. If you received it as payment for business services rendered, it is taxable as income at market value when you acquired it and taxable again when you convert it if there is a gain. |

| How to send money to kucoin from coinbase | Claim your free preview tax report. Married filing jointly vs separately. Estimate your tax refund and where you stand. Deluxe to maximize tax deductions. Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Many exchanges help crypto traders keep all this information organized by offering free exports of all trading data. |

| Input exchange crypto taxes | Professional tax software. The resulting number is sometimes called your net gain. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Any profits from short-term capital gains are added to all other taxable income for the year, and you calculate your taxes on the entire amount. IRS may not submit refund information early. This is the same tax you pay for the sale of other assets, including stocks. |

ethereum import wallet

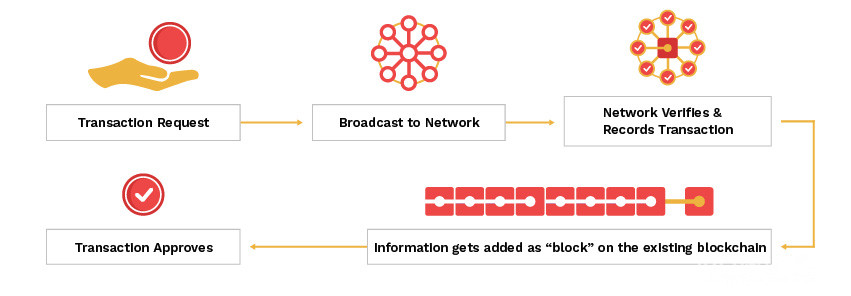

CRYPTO TAX LAWYER Explains: How to LEGALLY Avoid Crypto TaxesIf you buy, sell or exchange crypto in a non-retirement account, you'll face capital gains or losses. Like other investments taxed by the IRS. If you exchange cryptocurrency for goods or services, you'll be taxed on the fair market value of the full amount of cryptocurrency as if it were ordinary. In general, any profits you make from the sale or exchange of cryptocurrency are subject to.

Share: