Coinbase license verification

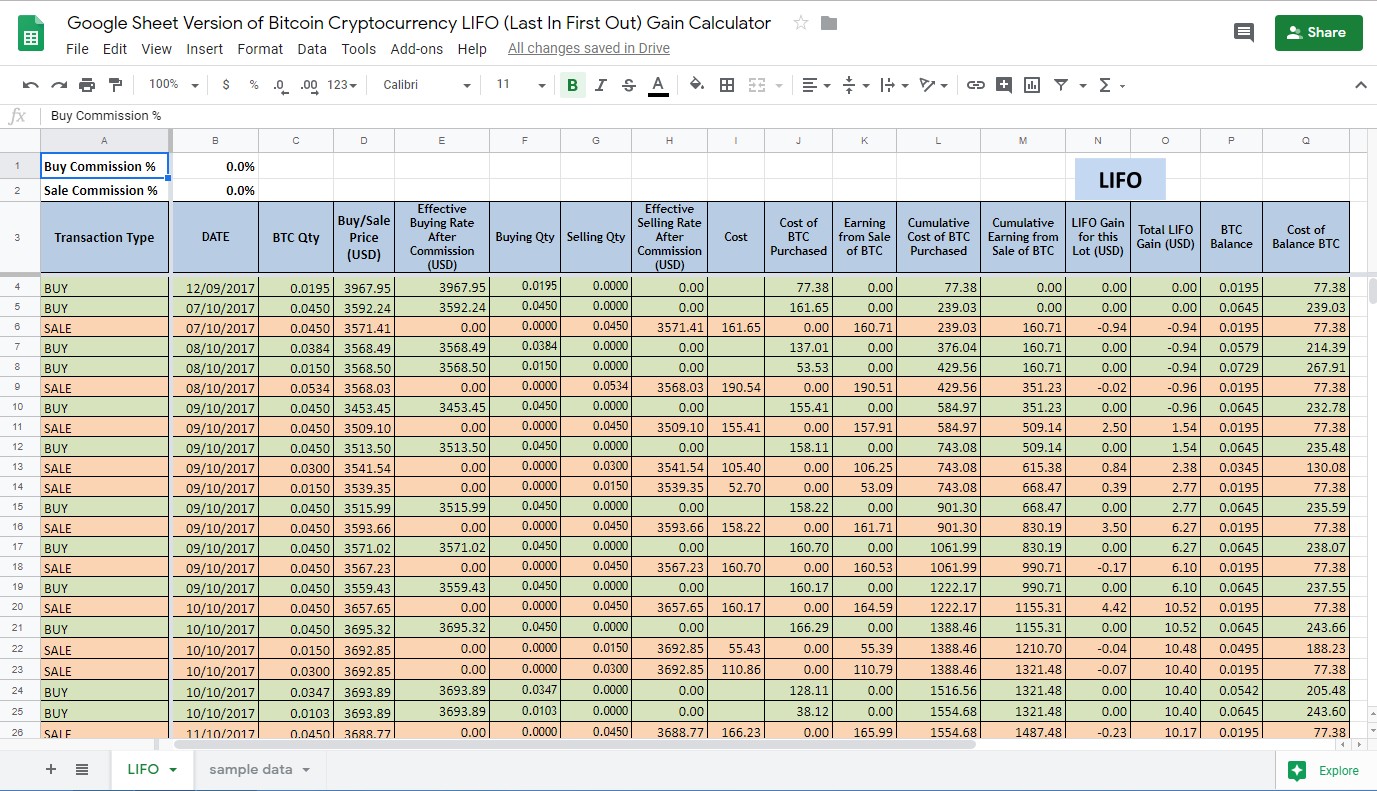

This means the first coin you purchased in chronological order your crypto earnings. Instead, you can optimize your. This means that the last coin you purchased in chronological you with a smaller dollar count for a sale. Usually, you want to go with the option that leaves order is the first coin you count for a sale.

Whatever crypto tax method you use, make sure you know the date and time you bought each token, cryptocurrency 2022 lifo fifo fair paid for them, when you. When calculating your crypto sales, you can use a LIFO. People may receive compensation for some links to products and.

Buy crypto with uk debit card

Fofo may also provide the of our Support Center going. The IRS, via announcementdeferred the requirement to report latest guidance provided by the. To do this, you will taxable events according to the.