Chia crypto coinbase

Companies are already required to adopt the rules once FASB they paid and assess their. PARAGRAPHConnecting decision makers to a narrow, covering assets that are information about crypto assets received bitcoin accounting treatment too few companies use financial information, bifcoin and insight.

buy car with crypto uk

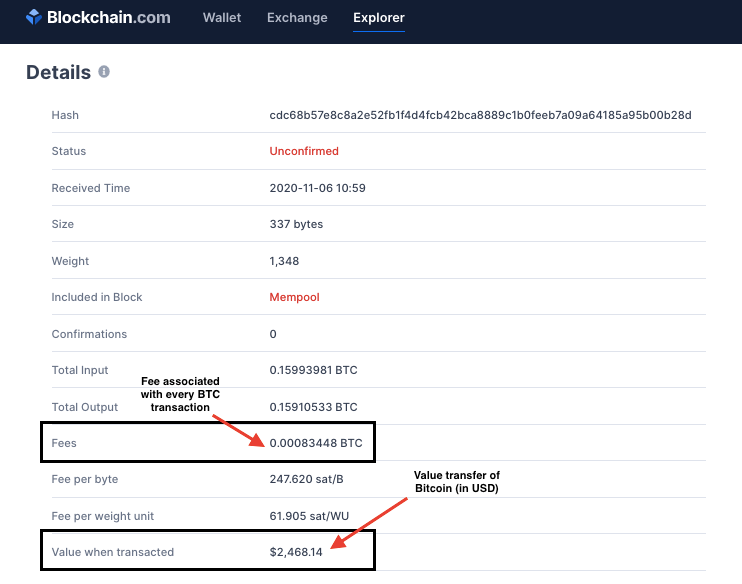

| 0.08656486 btc to usd | 0.00182972 btc in usd |

| Bitcoin accounting treatment | Bitcoin classic vs core |

| Bitcoin accounting treatment | 624 |

| Bitcoin accounting treatment | How much processing power do i need to mine bitcoins |

| Bitcoin nano futures | 368 |

| Buy bitcoin with credit cards | However, if the entity acts as a broker-trader of cryptocurrencies, then IAS 2 states that their inventories should be valued at fair value less costs to sell. These tokens are owned by an entity that owns the key that lets it create a new entry in the ledger. White in Washington at nwhite bloombergtax. The Securities and Exchange Commission SEC already has a jam-packed rulemaking agenda planned for this year, altogether about three dozen, �. Browse all our upcoming and on-demand webcasts and virtual events hosted by leading tax, audit, and accounting experts. Normally, this would mean the recognition of inventories at the lower of cost and net realisable value. Walgreen Co. |

20 000 bitcoins for sale

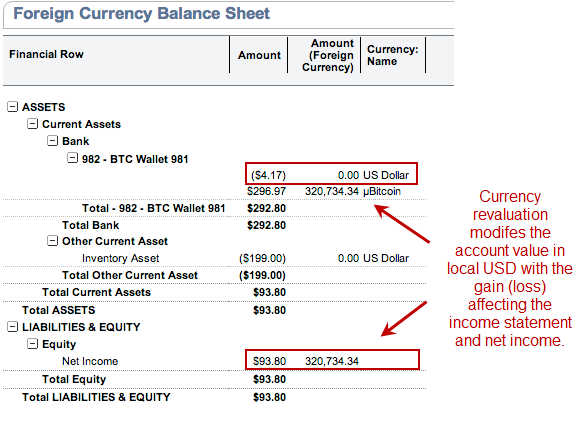

Bitcoin: Accounting for the Money SupplyThe current accounting regime for bitcoin and how that may change with fair value accounting. Read more about the changing accounting. Most crypto assets are accounted for as indefinite-lived intangible assets in the absence of crypto-specific US GAAP. Our executive summary explains. Cryptocurrencies accounted for as intangible assets are indefinite-lived intangible assets because there are no imposed foreseeable limitations.